How are your new year’s goals coming along? Have you been sticking with them or falling off the wagon a bit (no shame!)? If one of your goals this year was to do a better job at budgeting and saving more money (who doesn’t like having more money??), I’ve got some great tips for you today!

When I was a grad student at UC Davis, I had my first real salary from being a Teacher’s Assistant. It was a small salary, but I was excited! And it gave me an opportunity for my first foray into real budgeting and saving. It gave me a kind of thrill to know that if I planned my budget right and stuck to it, by the end of the year I know I’d have saved X amount.

And now that I’m self-employed, budgeting and saving are more important than ever. Here are my best budgeting and saving hacks that have helped me over the years!

1. Analyze your spending. Your first step to saving more money is to look at your current spending. Take a look at all your credit card statements over the last three months or so. Categorize everything as wants vs needs. Be honest with yourself here. Things like new clothes, coffee, dining out, and personal grooming are all wants. Your rent/mortgage, groceries, electric bill, etc. are needs—and even some of those can be shrunk down!

When it comes to your wants, think about where you can cut costs. Here are some personal examples that might apply to you too:

- Subscriptions: I was surprised to see I had several subscriptions I was being billed for monthly that I either no longer needed, or thought I had already canceled but hadn’t! Make sure to also check your app subscriptions on your phone that you may have forgotten about (instructions on how to do that on your iPhone here) as well as PayPal (instructions for PayPal here).

- Coffee: I love a delicious cup of coffee to start my day, and it’s absolutely part of my morning routine. But spending $5 a day on coffee is absolutely ridiculous. I have a girlfriend who recently looked over her spending from 2019 and realized she had spent over $3,000 on her daily coffees! That is just crazy. You can absolutely make your own coffee at home and have it be just as delicious, if not more, as what you would purchase at a coffee shop. I personally prefer my own coffee that I make at home because I’ve figured out how to make it exactly how I like it—not too sweet, and smooth and creamy. You can get a milk frother for less than $20 on Amazon (be sure to check Ibotta for any Amazon offers) and make your own lattes at home. I like to dress mine up with Nutpods coconut creamer, cinnamon, collagen, and a little bit of coconut oil. So. Good.

- Nails: I like having nice nails, and with my business, it doesn’t really work to have chipped nails at photoshoots or for unboxing videos. But I’d rather not spend ~$50 on a mani once or twice a month. Instead, I’ve been doing press-on nails and saving so much money (and time!). Y’all, press-ons have come a long way since I last tried them in high school. If you follow me on Insta (@wtfab), you’ve probably seen me raving about them. But basically it costs $2.50 per manicure, takes me 10 minutes, and lasts up to two weeks.

2. Set a budget. After you’ve taken a good hard look at your spending and figured out where you can cut back, set a budget for yourself. You can do this using different apps (I like Mint), or with a good old fashioned spreadsheet. Just make sure you’re setting a realistic budget, and sticking to it each month.

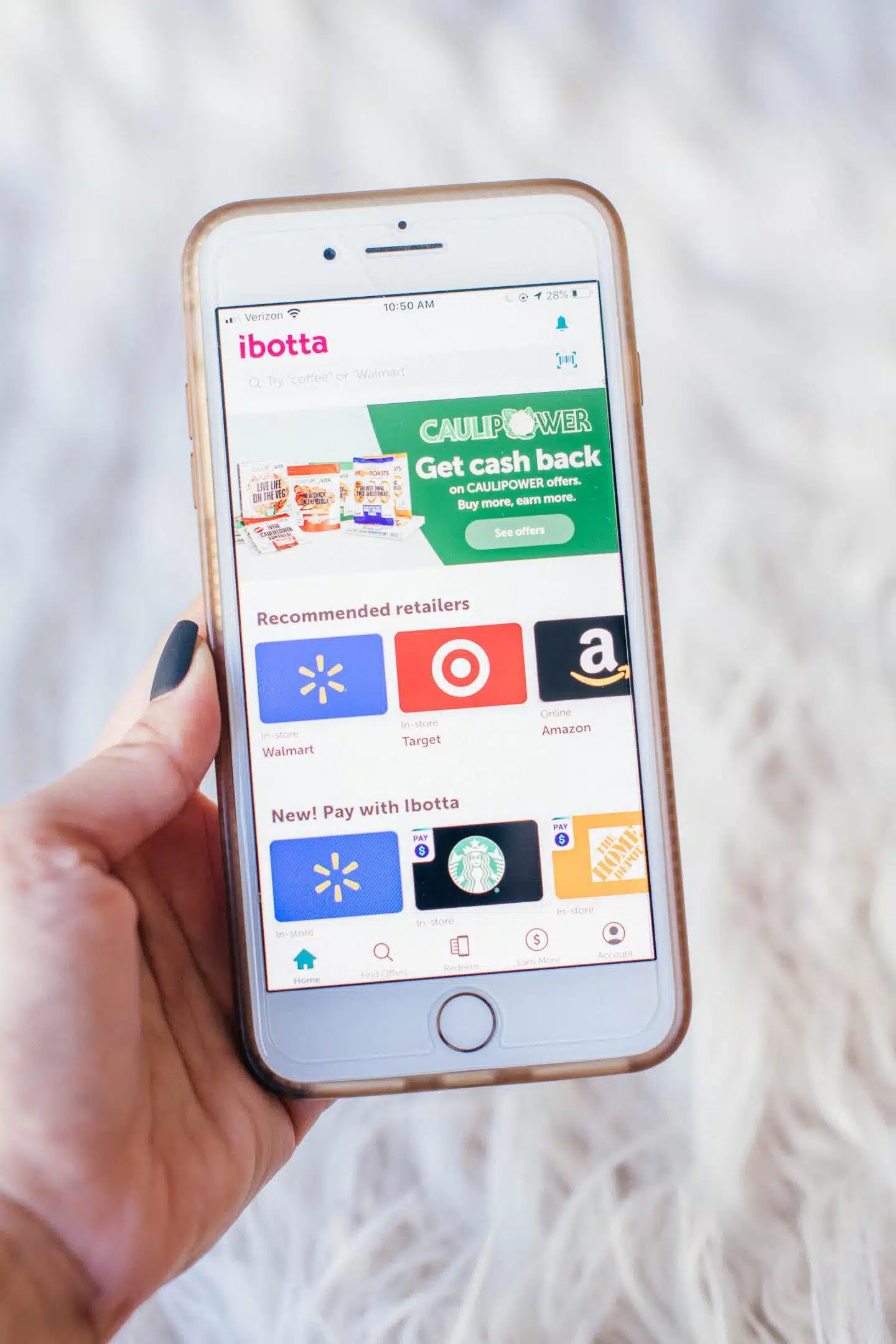

3. Use Ibotta for Cashback. If you aren’t using Ibotta, you’re missing out on free money. Literally. Ibotta helps you earn cash back on things you’re already spending money on—like groceries, travel, online shopping, and restaurants. I just earned cash back on a VRBO we booked for our upcoming Europe trip, and a rental car we got through Hertz on our recent Maui trip. The possibilities for earning cash back on Ibotta are seriously endless, so I’m basically always checking the offers section on the app whenever I’m spending money on literally anything.

You can sign up for Ibotta here!

4. Buy some CDs and/or open a high-yield savings account. This is a big change I made last year that has also helped me earn free money—I moved all of my savings from a regular savings account (that was basically earning me pennies in interest) to a high-yield saving account with Capital One, earning me 5x the national average for returns.

This is a pro tip from my dad, but if you have a chunk of savings sitting there, another thing you can do is keep an eye on CD rates and purchase CDs when their rates are high (or higher than your current savings account). CDs are Certificates of Deposits and are a secure, FDIC-insured form of deposit, where money must stay in your bank for a certain period of time (usually six months, one year, or two years), for a promised return rate. CDs usually earn more interest than a regular savings account, and last year CD rates were as high as 3%. It feels SO good to check my account every month and see money deposited into it for literally doing nothing.

*As a legal note, I’m obviously not trying to be your financial advisor. Please do your own research, make sure any CDs you purchase are FDIC-insured, and speak with your own financial advisor to determine what would work best for you.

5. Pack your lunch. It is so tempting to grab lunch somewhere near your office, but you’ll save so much money (and probably eat healthier) if you make your lunch ahead of time and bring it. Even though I work from home now, it’s still tempting to grab lunch somewhere close by! Omied and I like to do easy hacks like pick up a rotisserie chicken (hello, $4.99 at Costco—don’t forget to use your Ibotta app!) and shred it up to use for chicken sandwiches, wraps, and salads during the week.

6. Meal plan. As easy as it is to want to grab something for lunch during the workday, it’s equally tempting to order in dinner after a long, stressful day. I’m far less likely to do that if I’ve planned out and prepped my meals at the beginning of the week. Omied and I like to make big batches of healthy, hearty dishes, like chili, stews, casseroles, etc. that we can eat a couple of nights in a row and also take for lunch at work. Also, consider creating a budget grocery list to help you save even more money when you’re meal planning.

To make grocery shopping as efficient as possible, I do one Costco run a month, and the rest of the month I do Amazon Fresh deliveries. You can earn cashback for both of these retailers on Ibotta!

7. Purge and sell. Twice a year, Omied and I do a huge closet/apartment purge. You can read all my tips on how to declutter fast and organize your home here. While I do donate most of what I’m purging, I sell some of my items to earn some extra cash. I’ll list items on Poshmark and consign through ThredUP.

I hope you found these budgeting and saving tips useful! If you implement any or all of them, let me know how it goes!

Thank you to Ibotta for sponsoring this post! All offers were valid as of the publishing date. Don’t forget to check your app for details as offers change frequently and may not be available in all areas.

Elise Armitage is an entrepreneur and founder of What The Fab, a travel + lifestyle blog based in California. At the beginning of 2019, Elise left her corporate job at Google to chase her dreams: being an entrepreneur and helping women find fabulous in the everyday. Since then, she’s launched her SEO course Six-Figure SEO, where she teaches bloggers how to create a passive revenue stream from their website using SEO. Featured in publications like Forbes, Elle, HerMoney, and Real Simple, Elise is a firm believer that you can be of both substance and style.